All Risk Insurance Coverage

All risk insurance typically covers a wide range of potential risks, protecting against loss or damage to property. Here’s a general description of what such coverage might include:

1. Comprehensive Coverage : Protects against a variety of risks, including theft, vandalism, fire, and natural disasters.

2. Property Coverage : Covers buildings, equipment, inventory, and personal property.

3. Liability Protection : May include liability coverage for injuries or damages to third parties.

4. Business Interruption: Some policies cover loss of income due to business interruptions caused by insured events.

5. Additional Options: Policies can often be tailored with endorsements for specific risks relevant to your business.

For exact details, it’s best to refer to the specific policy documents or contact RD Insurance directly, as coverage can vary widely by provider and policy.

Types Of All Risk Insurance Coverage :

1. Property Coverage

- Buildings and Structures: Covers damage to physical buildings owned or rented.

- Contents: Protects furniture, fixtures, equipment, and inventory from various risks.

- Outdoor Property: May include coverage for landscaping, signage, and outdoor equipment.

2. Theft and Vandalism

- Coverage for loss or damage resulting from theft or vandalism, including break-ins and graffiti.

3. Natural Disasters

- Protection against risks such as fire, storms, floods, earthquakes, and other natural events, depending on the policy.

4. Liability Coverage

- General Liability: Protects against claims of bodily injury or property damage to third parties.

- Product Liability: Covers claims related to products sold or manufactured by the business.

- Professional Liability: For businesses providing professional services, covering errors or omissions.

5. Business Interruption

- Covers loss of income if the business cannot operate due to an insured event, including ongoing expenses during the downtime.

6. Additional Coverages

- Equipment Breakdown: Covers damages due to mechanical failure or electrical issues.

- Cyber Liability: Protects against data breaches or cyber-attacks, including costs for notification and recovery.

- Environmental Liability: Coverage for pollution-related claims or cleanup costs.

7. Customization Options

- Policies can often be tailored with endorsements to cover specific needs, such as fine arts, valuable collections, or unique business risks.

8. Exclusions and Limitations

- Most all risk policies will have certain exclusions, such as wear and tear, intentional damage, or specific types of natural disasters.

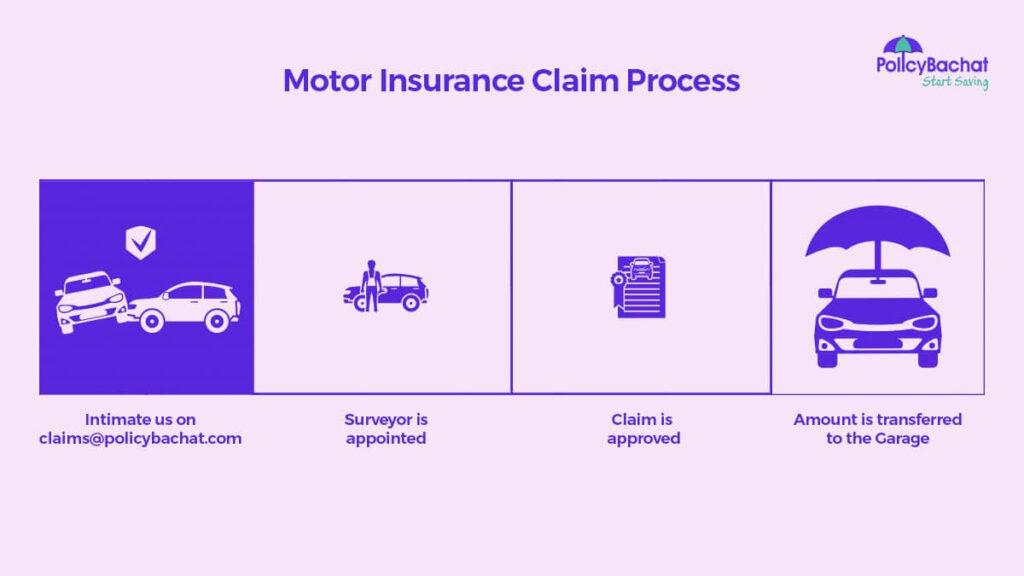

9. Claims Process

- Typically involves notifying the insurer, providing documentation of the loss, and working with adjusters to assess damages.

10. Premiums and Deductibles

- Premiums are based on factors like the type of business, location, value of insured items, and coverage limits. Deductibles will apply to claims, affecting out-of-pocket costs.

For the most accurate and tailored information, reviewing the specific policy details from RD Insurance or consulting with their representatives would be beneficial.